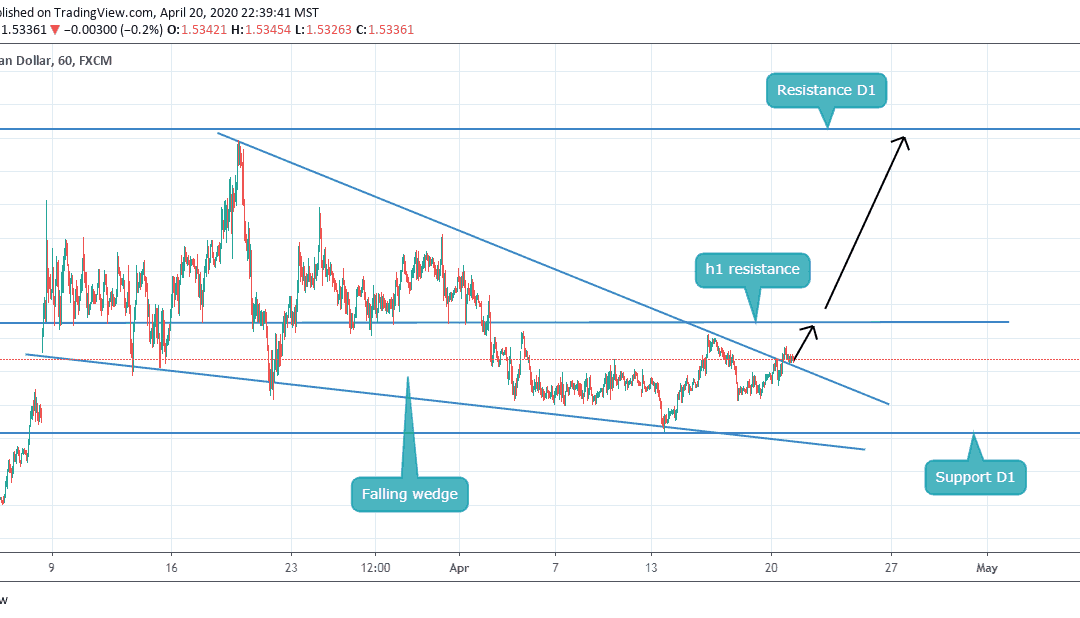

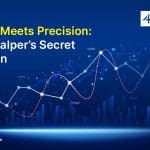

by Ryan Lopes | Apr 20, 2020 | EURCAD, Forex Trade Ideas

Hello my fellow traders, hope you all are making some profits. We are here with our new analysis so that we can increase those profits for you. Let’s get into the analysis. As we can see that the pair has given a Falling Wedge breakout on upside and is retesting now....

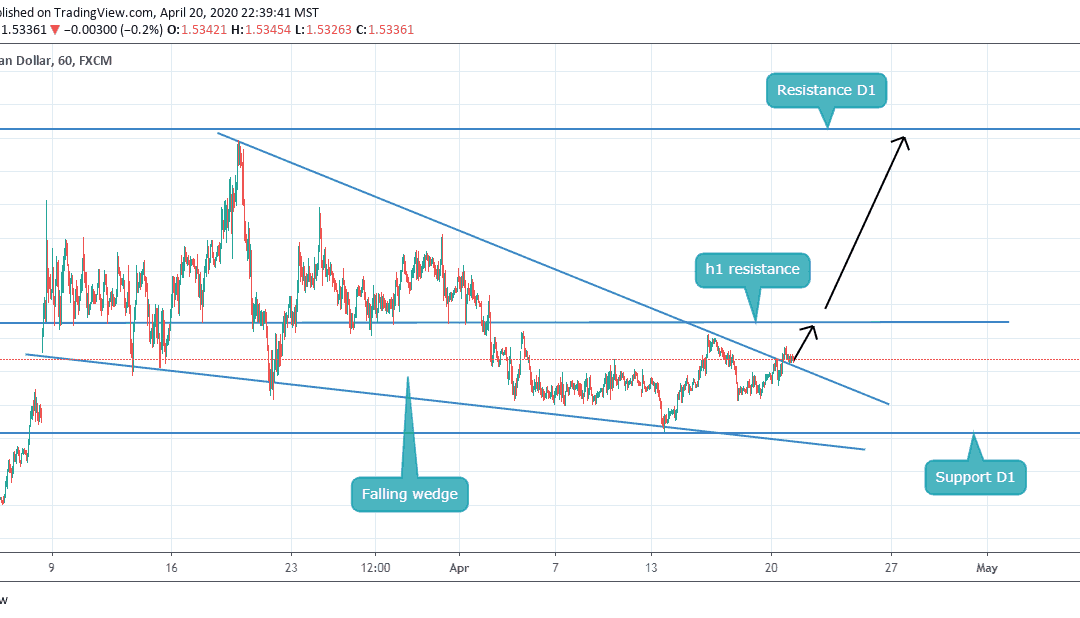

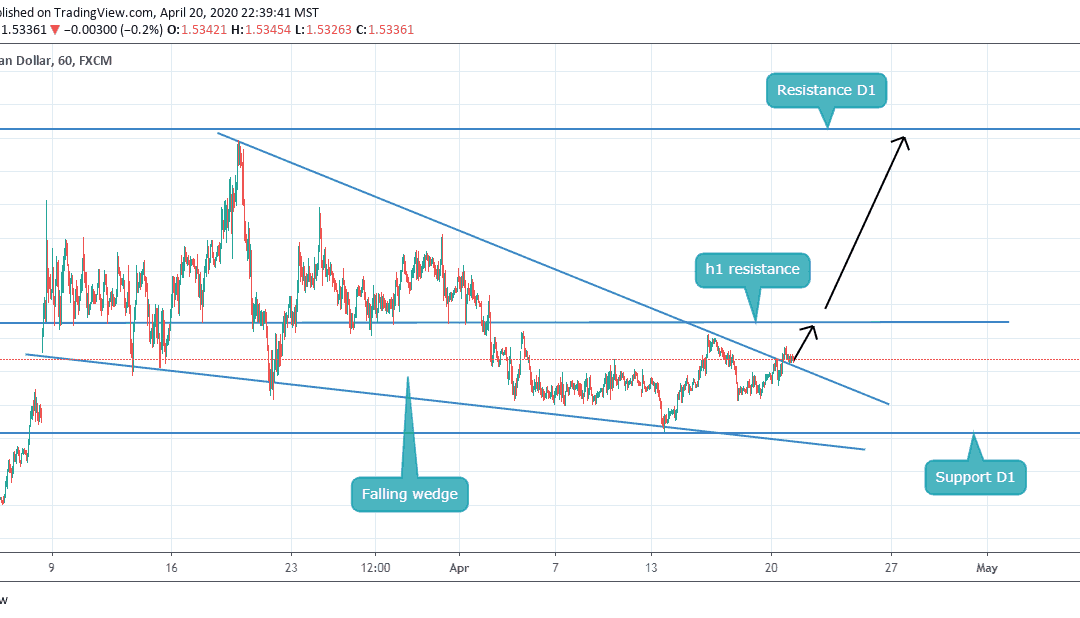

by Ryan Lopes | Apr 20, 2020 | AUDJPY, Forex Trade Ideas

Hello my fellow traders, hope you all are making some profits. We are here with our new analysis so that we can increase those profits for you. Let’s get into the analysis. As we can see that the pair broke its rising wedge and started falling down. One can take a...

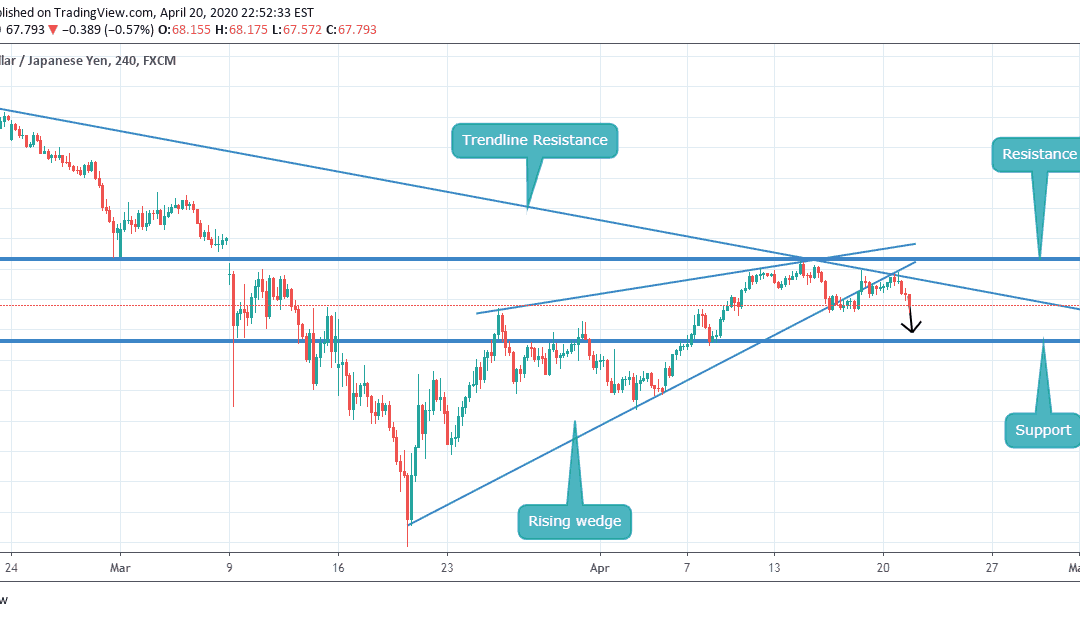

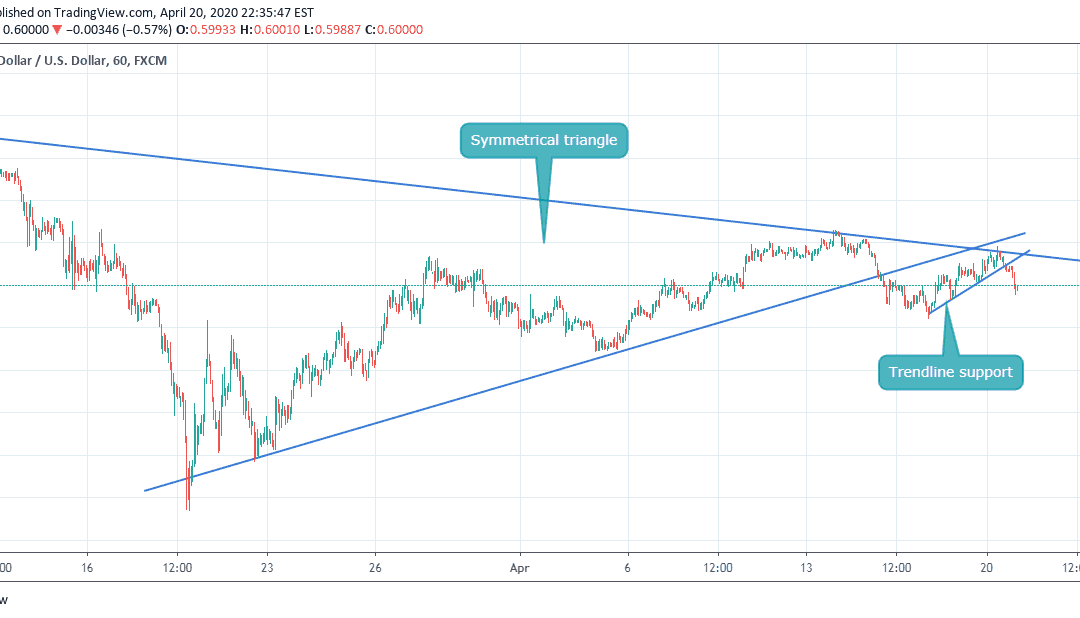

by Ryan Lopes | Apr 20, 2020 | Forex Trade Ideas, NZDUSD

Hello my fellow traders, hope you all are making some profits. We are here with our new analysis so that we can increase those profits for you. Let’s get into the analysis. As we can see that the pair broke its Symmetrical triangle and started falling down. One can...

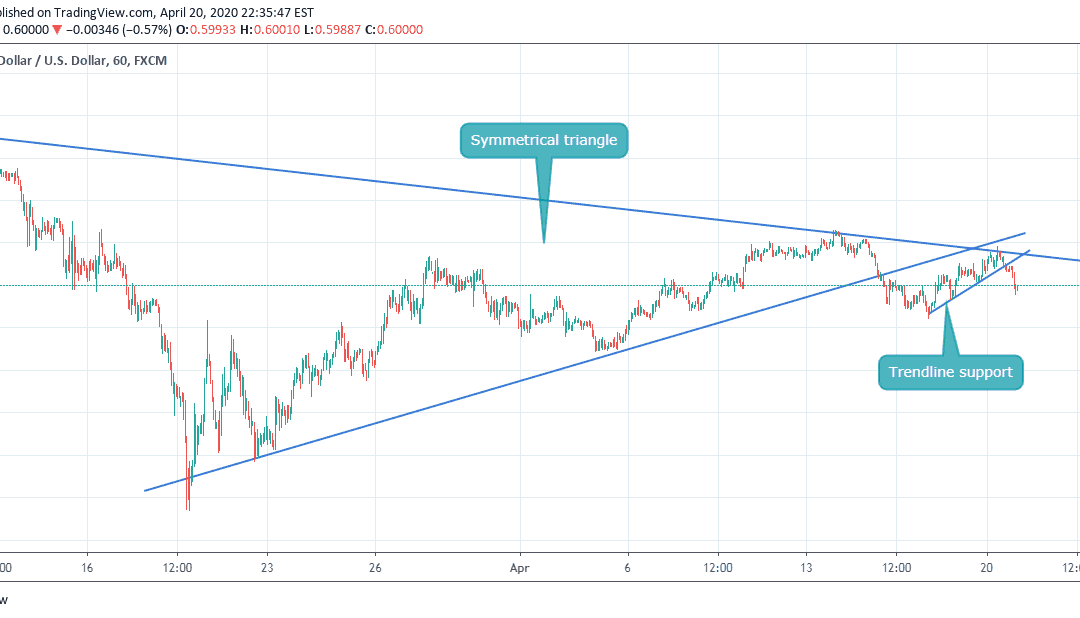

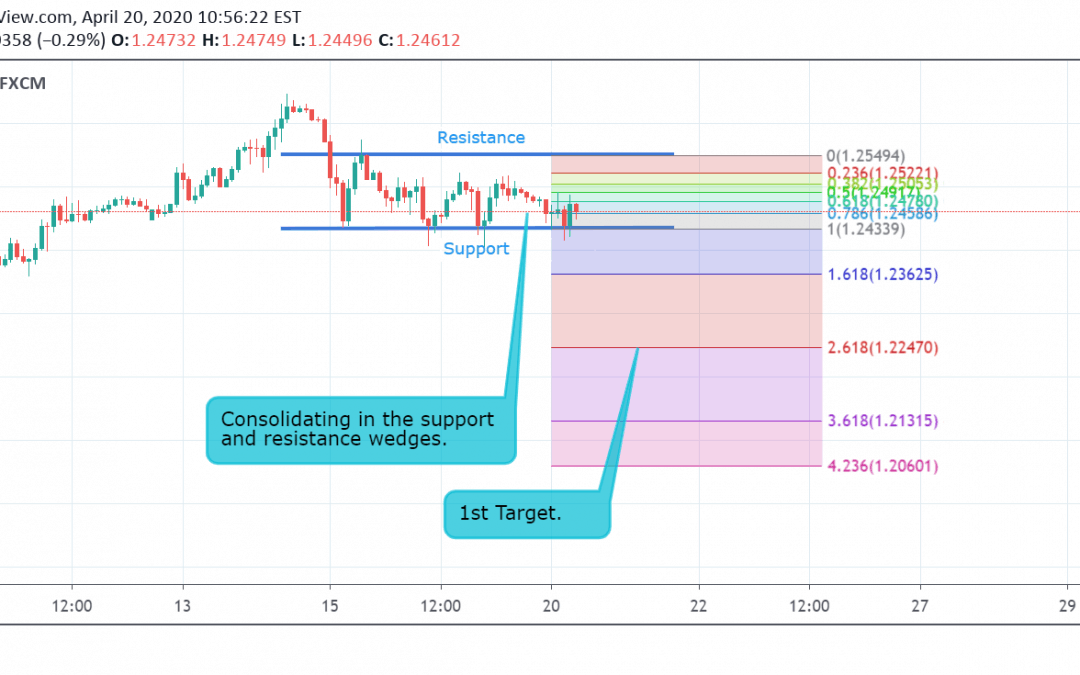

by Rishikesh Lilawat | Apr 20, 2020 | Forex Trade Ideas, USDCAD

Currently, USD/CAD is trading at 1.4060. The pair started a sideways trend on 30 March and now consolidating in the support and resistance wedges . If the price breaks its support level at 1.3855, then it may touch its support zone at 1.3545. If the price breaks...

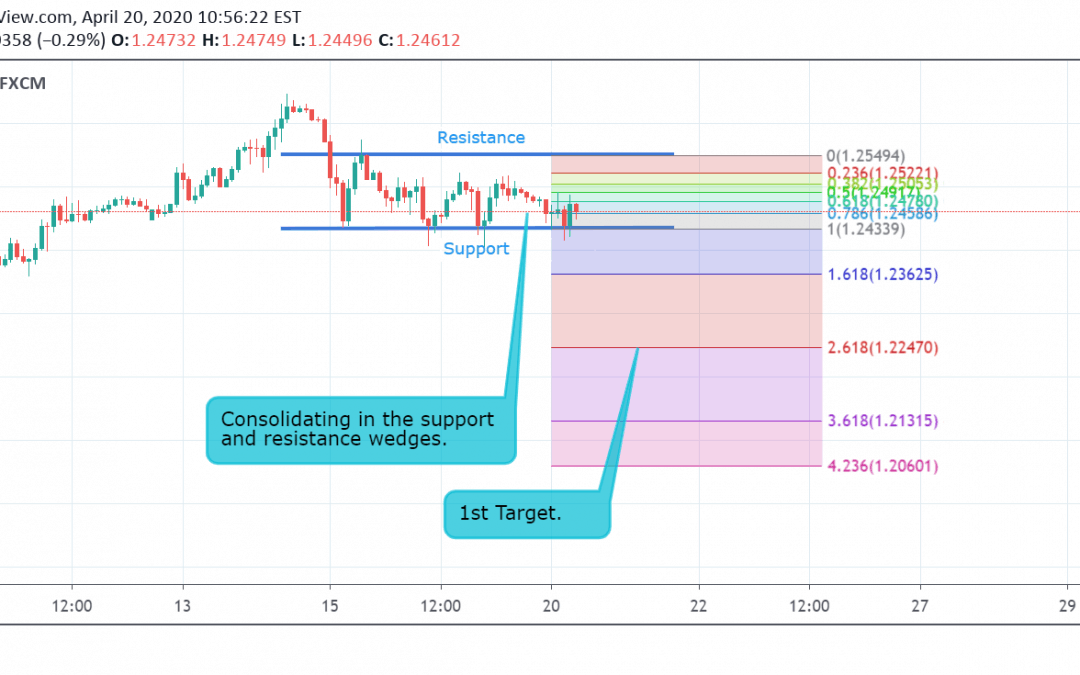

by Rishikesh Lilawat | Apr 20, 2020 | Forex Trade Ideas, GBPUSD

Currently, GBP/USD is trading at 1.2462. The pair started a sideways trend on 14 April and now consolidating in the support and resistance wedges . If the price breaks its support level at 1.2433, it may enter into a new downtrend and then its next support level at...

by Vivek | Apr 20, 2020 | EURCHF, Forex Trade Ideas

EURCHF is trading in channel pattern, we might see some downside in EURCHF from the current price level and the target will be a support line for Channel pattern. On can trade on the short side with strict stop loss. If You Like The Idea, Do Follow/Comment/Like For...