Matrix Trade Signals

Our Matrix Trade Signals combine all of our technology to give you powerful trade alerts. When using our alerts, please follow our rules and trade safely. Keep the math in your favor and you will succeed!

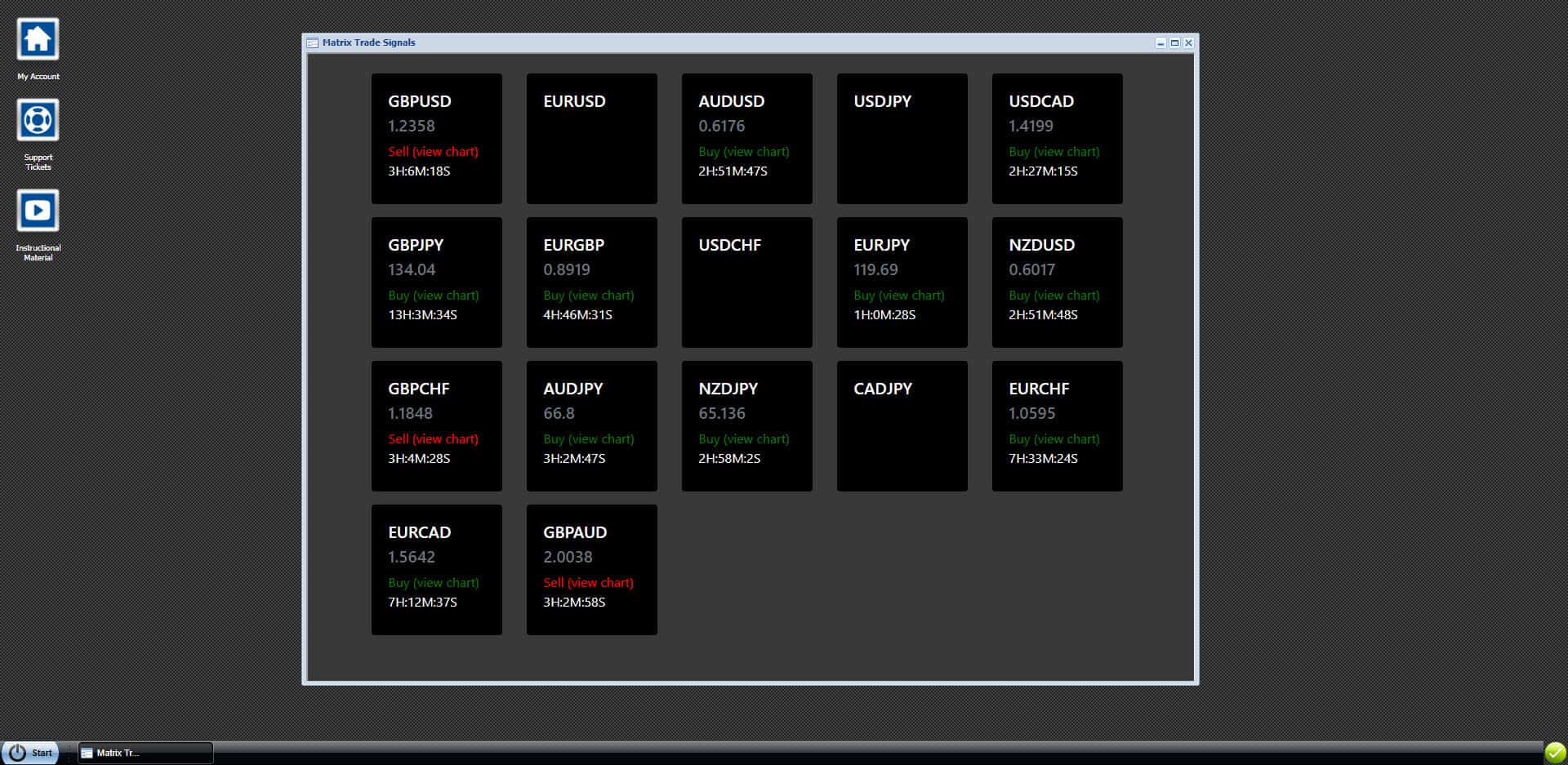

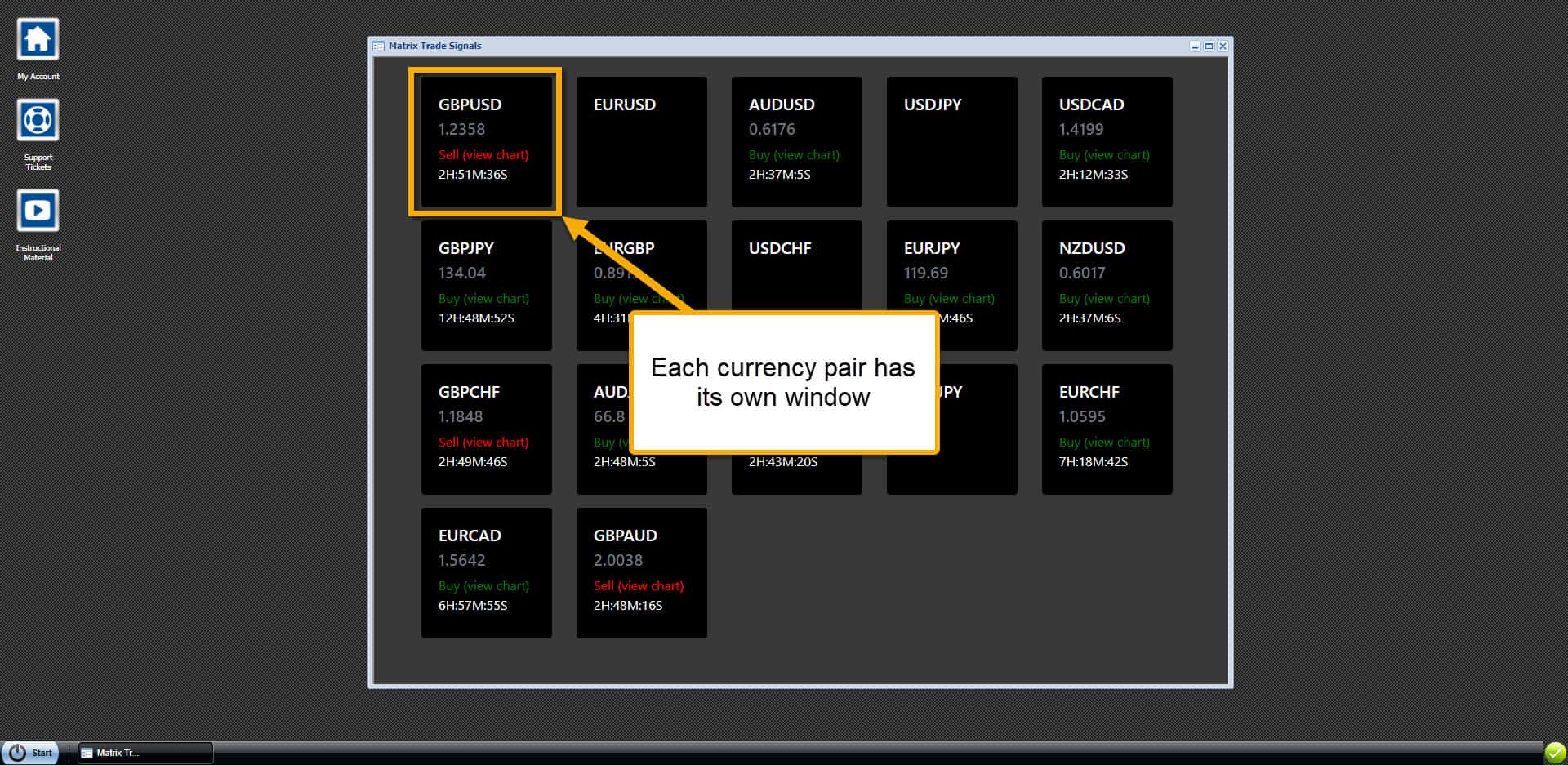

Signal Blocks

Each of the 17 currency pairs have their own data block to display information about each trade signal. From top to bottom:

- Currency Pair (the name of the currency pair the signal is based on)

- Price (the price the signal was generated – your target entry price)

- Buy/Sell & Chart Shot (we capture a chart image when each signal is generated for reference)

- Timer (the timer show how long the signal has been running – or how old it is)

If the data values below the currency pair name are empty, there are no recent signals to display.

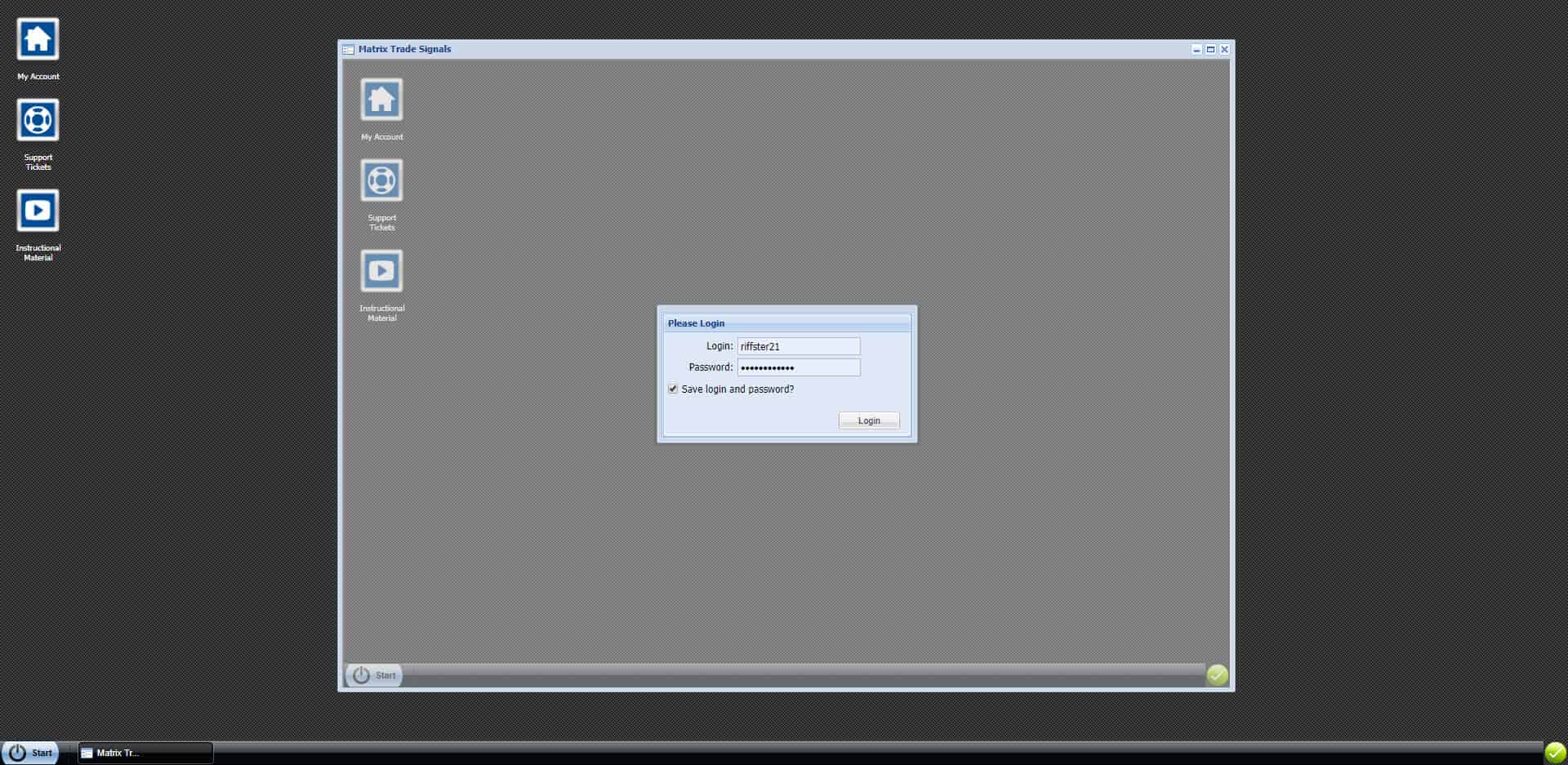

Forced Login

Ocassionally, when you open a trading tool (like the Matrix Trade Signals), you’ll be asked to log in again. If this happens, just input your information as you normally would, click the “Login” button, close the window and relaunch the tool.

When we reset data feeds for some of our trading tools or send an update to a trading tool, you may be asked to login again.

Matrix Signal Notifications

Currently, we provide 2 notification options for our Matrix Trade Signals. You can select these options from your Pro Member account page, under “Customer Profile”. Your options are:

- Pop-Up (sends a pop-up notification inside the Trader’s Desktop)

- Email (send an email notification to your primary email address)

- Both (you can select both options)

NOTE: remember to click “Save Profile” before you exit the “Customer Profile” page or your settings won’t be saved!

Using Our Signals

To use our trading signals, you will use an online tool (or you can do the math manually, but we recommend using the tool) and the ATR values from our ATR Matrix. Please follow our simple instructions. If you have questions, please contact us for help.

- Locate the 60Min ATR values for the currency pair that you are trading

- To calculate the total number of pips for your Stop order, multiply the 60Min ATR by 2.7

- To calculate the total number of pips for your Limit order, multiply the 60Min ATR by 4.3

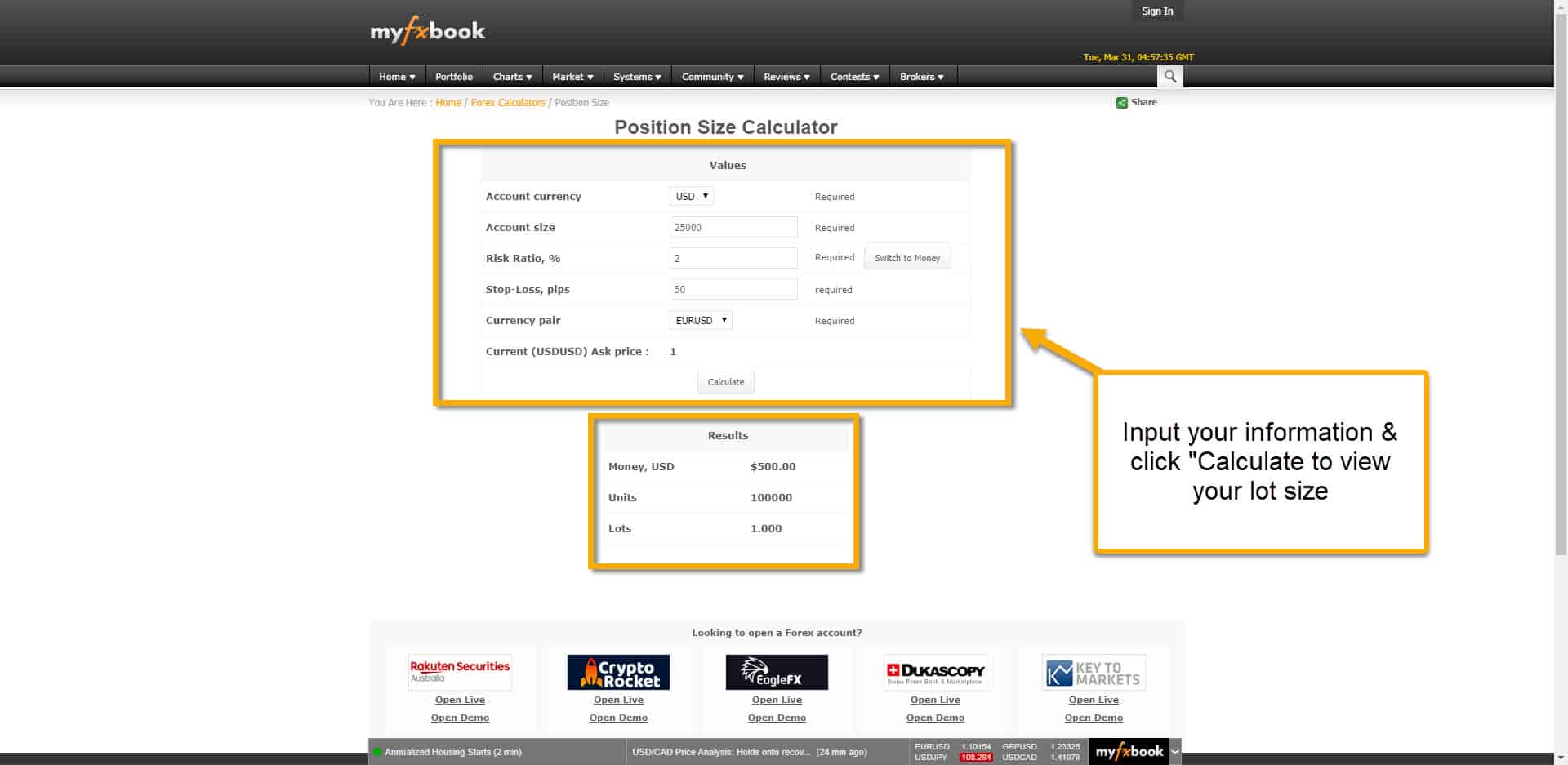

Now you have the total number of pips for your Stop and Limit orders. Next you need to calculate your lot size (the size of your trade). To do this, open up the online tool (we like the MyFXBook tool) and input your trade information. From top to bottom:

- Account Currency (the deposit currency of your account – we used USD for this example)

- Account size (use your fixed equity and not your floating balance – we used $25,000 for this example)

- Risk Ratio (input “2” for 2% risk, please do not risk more than this)

- Stop-Loss Pips (use the total number of pips calculated in Step 2 from above – we used 50 for this example)

- Currency Pair (select the currency pair that you are trading – we used the EURUSD for this example)

- Click on the “Calculate” button at the bottom to see your lot size

In this example, our lot size is 1 standard lot or 100,000 units (i.e., a mini lot is 10,000 units). We would open our EURUSD trade with 1 standard lot, then place a 50 pip Stop and a 79 pip Limit (we used a 18.5 60Min value for this example).

Following Our Signals

Following our Matrix Trade Signals is pretty simple. The hard part is calculating your Stop, Limit and Lot Size (and that’s not very hard either). There are 6 possible options when following our trade signals and we will outline each one in detail:

- If it is a buy signal and you are NOT in a trade yet – follow the instructions above and open a buy/Long trade for the designated currency pair.

- If it is a sell signal and you are NOT in a trade yet – follow the instructions above and open a Sell/Short trade for the designated currency pair.

- If it is a buy signal and you are already in a Buy/Long trade – move your Stop and Limit based on the new entry price (this should give you a smaller Stop and a larger Limit). If the new signal entry price is lower than the trade that you have open, close your position and wait for the next signal.

- If it is a sell signal and you are already in a Sell/Short trade – move your Stop and Limit based on the new entry price (this should give you a smaller Stop and a larger Limit). If the new signal entry price is higher than the trade that you have open, close your position and wait for the next signal.

- If it is a sell signal and you are already in a Buy/Long trade – close your position and wait for the next signal.

- If it is a buy signal and you are already in a Sell/Short trade – close your position and wait for the next signal.

As always, if you have any questions, please ask and we will be happy to help! We also have live example on our Forum (here).

NOTE: Please demo trade first before using live funds! While demo trading, you should establish a consistent pattern of winning trades before you begin trading real money.