Scalping Matrix

Now that you understand the concepts behind our other tools, our Scalping Matrix will be easy to understand and use.

NOTE: if you have not completed the tutorials for our other tools, please do so before completing this tutorial.

High-Frequency Trading

Most of our tools require a lot of patience to use, and the Scalping Matrix is no different. However, you will find more trades, more often with this tool. The Scalping Matrix is designed to find short/quick corrections in the market, but you might find a completely different method of using the data. Our Pro Members are constantly submitting new systems designed around the Scalping Matrix. You can find their ideas (here) on our forum. Please consider sharing your ideas as well. When our Pro Members share ideas, everyone wins.

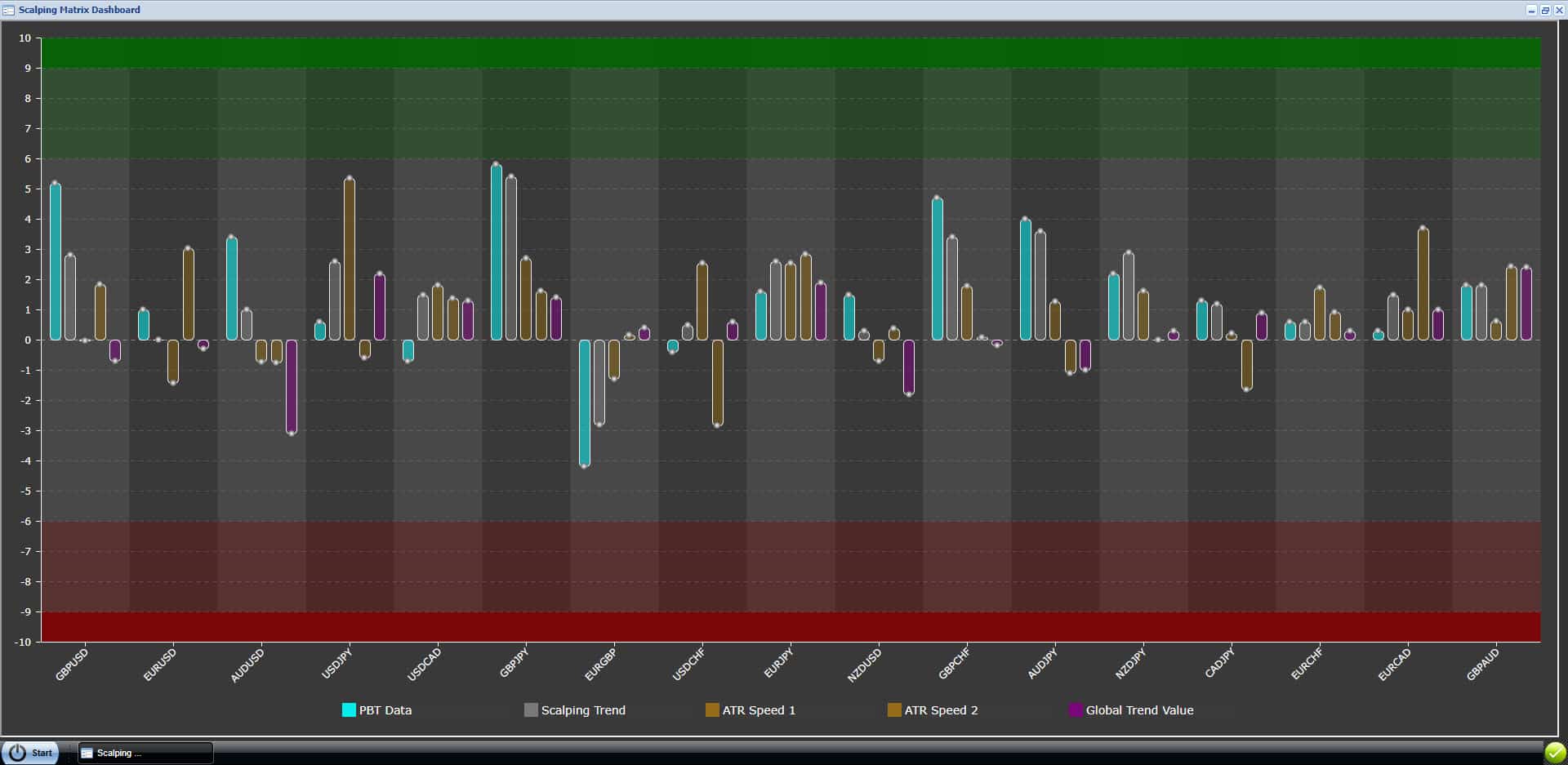

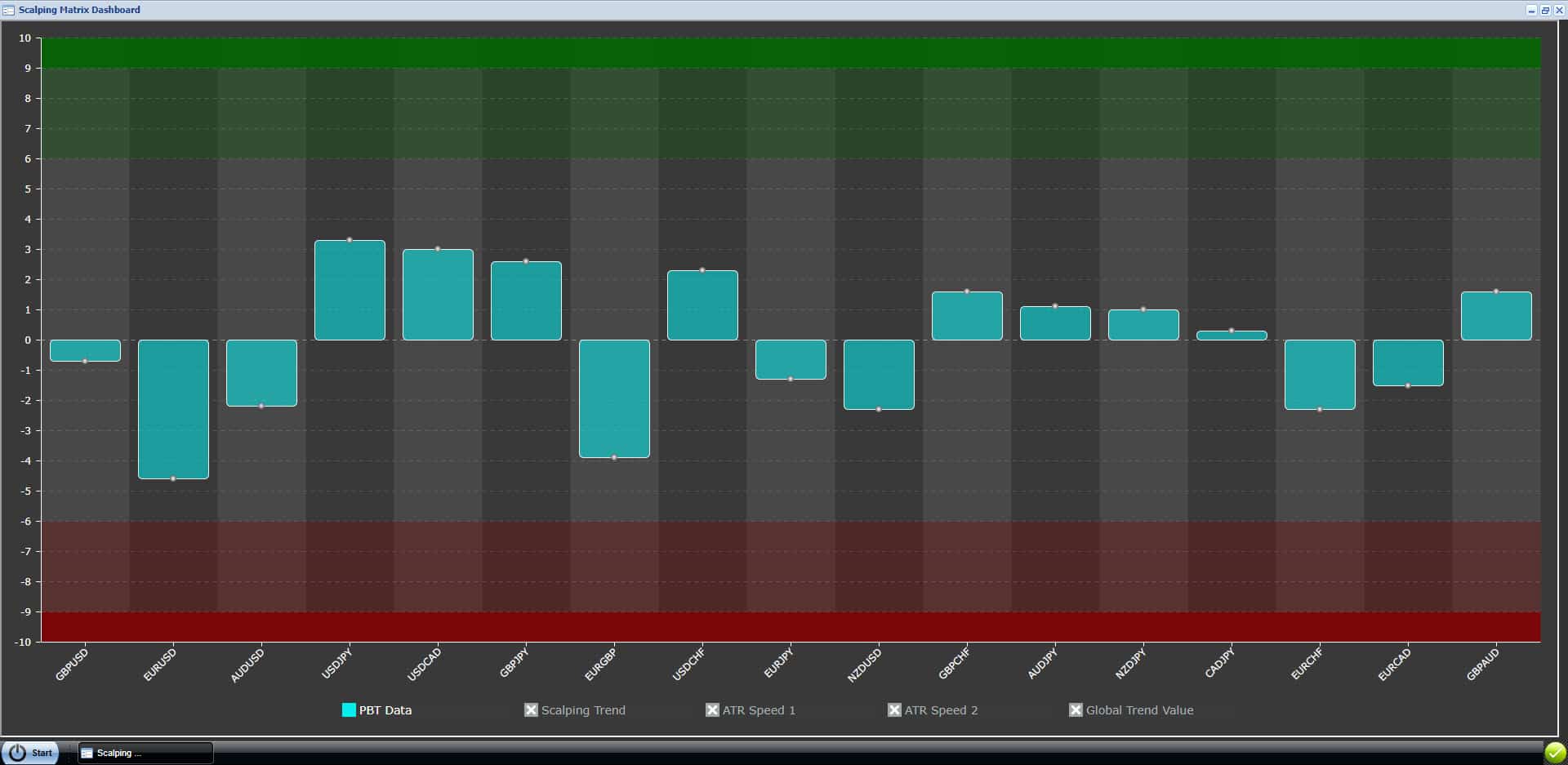

Most of the Scalping Matrix data is a composite of data from our other trading tools. Let’s take a closer took:

- PBT Data – This data is a composite of our Currency Matrix (but using very short time frames) and weighted to broadcast a prediction of when a currency pair is overextended.

- Scalping Trend – Similar to the PBT data, but it uses slightly larger time frames as well as the shorter time frame from our Global Trend Value

- ATR Speed 1 – This data is a composite of our Trend Matrix 1 Min and 5 Min data.

- ATR Speed 2 – This data is a composite of our Trend Matrix 5 Min, 15 Min and 30 Min data.

- Global Trend Value – We use this data to determine the long term or primary trend direction and it’s relative strength. The Global Trend Value is a composite average of our trading tool data + several technical indicators. It would take more than 20 live charts per currency pair to replicate the data. It’s very accurate!

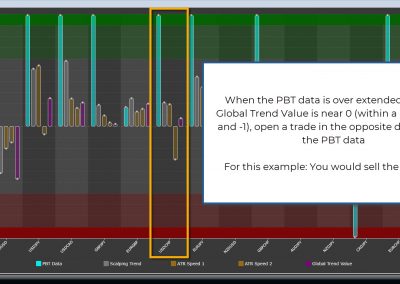

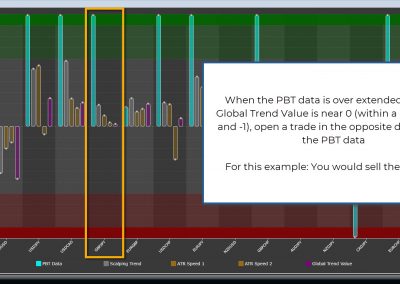

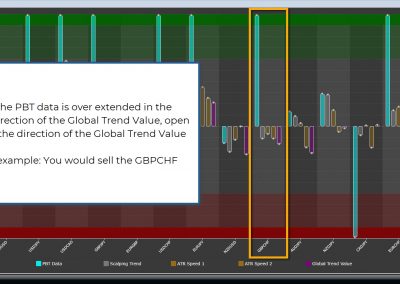

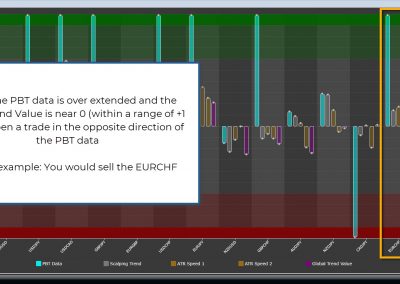

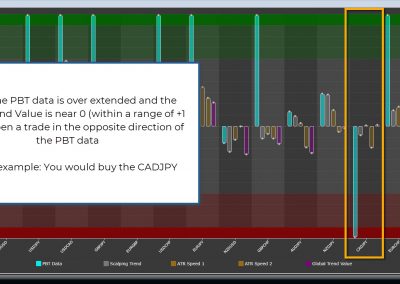

The PBT data is our primary indicator for entering a trade. See examples in the next section.

PBT Data

The Scalping Matrix has shorter time-frame data sets, but PBT Data is the fastest of all our data sets. PBT data is the most reactive with zero market price lag. Meaning, you can trade directly from the PBT data without making adjustments for time interval lag. Popular technical indicators like Moving Averages, RSI, Fractals, MACD, etc… all suffer from market price lag in one form or another. We designed all of our tools to be reactive and “lag free” and PBT data is fastest because of the shorter time intervals driving the algorithm.

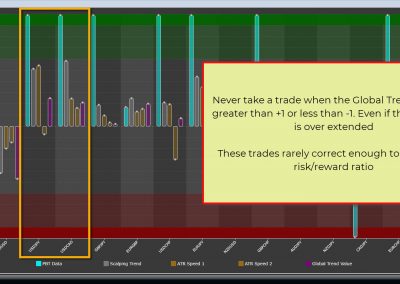

Below are some examples of how to use the Scalping Matrix to find trades. You can find more examples on our forum. NOTE: we also included 2 examples of when “not” to take a trade.

Setting up your Scalping Matrix trades

When you find a Scalping Matrix trade, you will use an online tool (or you can do the math manually, but we recommend using the tool) and the ATR values from our ATR Matrix. Please follow our simple instructions. If you have questions, please contact us for help.

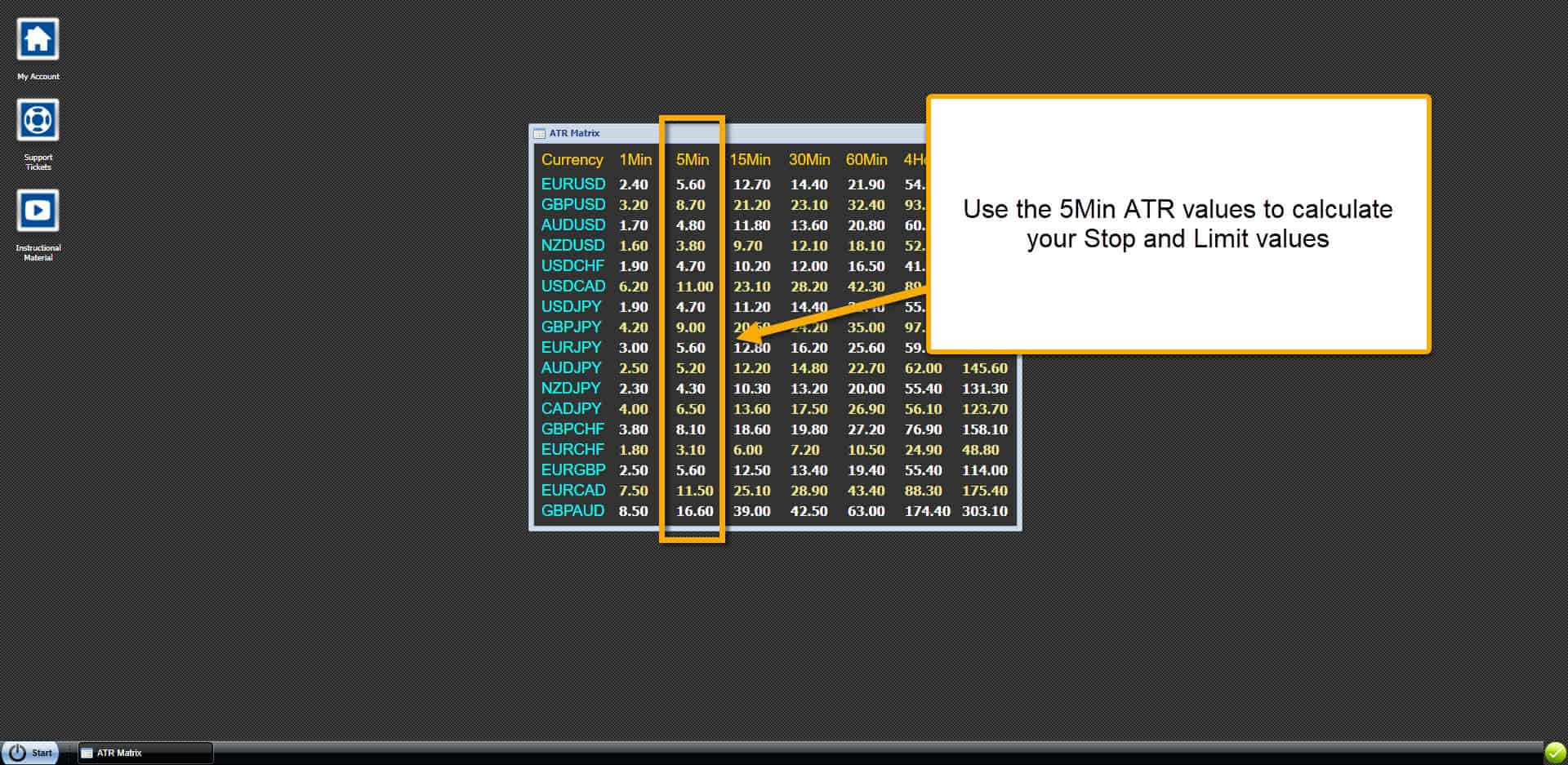

- Locate the 5Min ATR values for the currency pair that you are trading

- To calculate the total number of pips for your Stop order, multiply the 5Min ATR by 2.7

- To calculate the total number of pips for your Limit order, multiply the 5Min ATR by 4.3

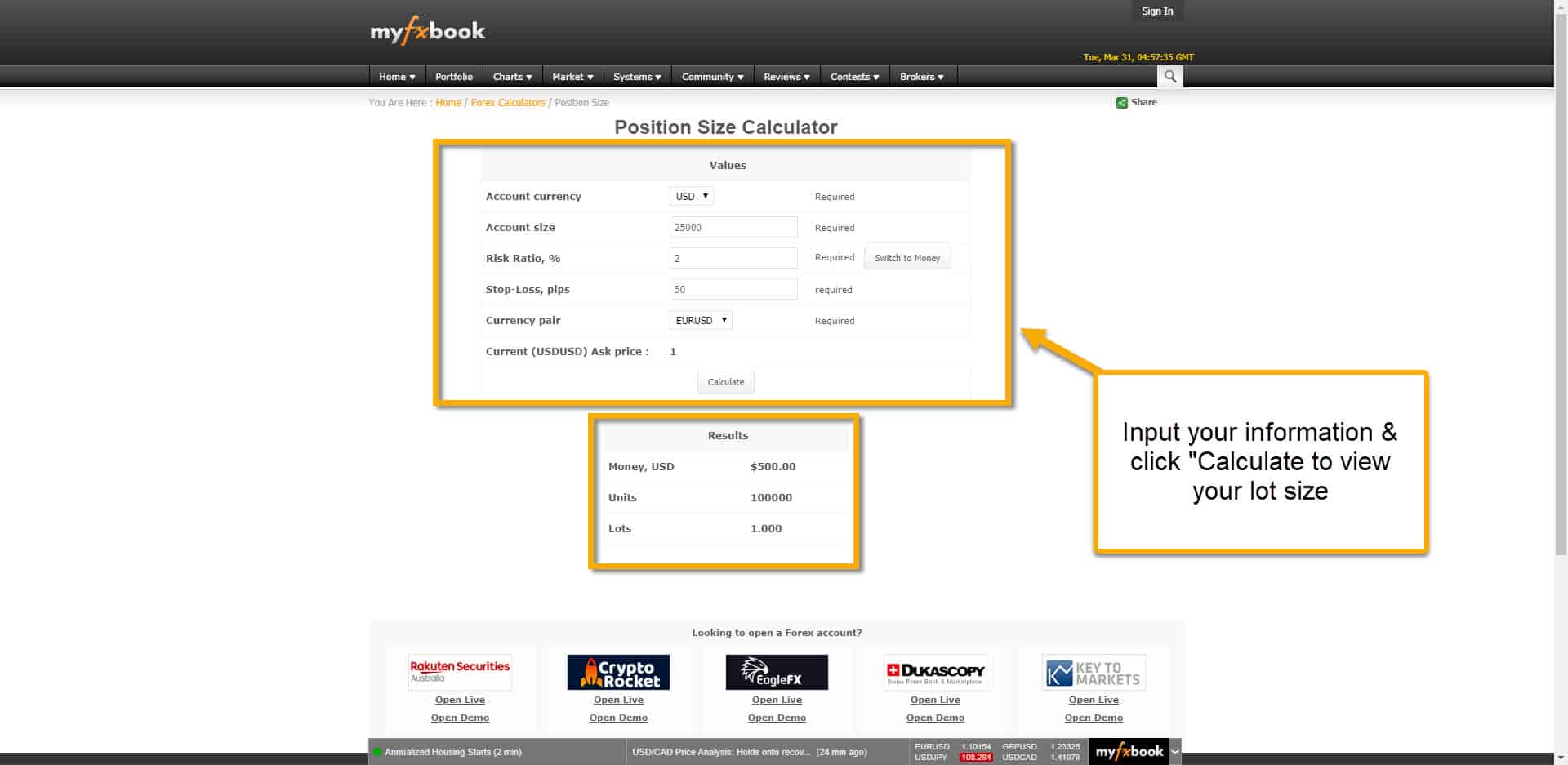

Now you have the total number of pips for your Stop and Limit orders. Next you need to calculate your lot size (the size of your trade). To do this, open up the online tool (we like the MyFXBook tool) and input your trade information. From top to bottom:

- Account Currency (the deposit currency of your account – we used USD for this example)

- Account size (use your fixed equity and not your floating balance – we used $25,000 for this example)

- Risk Ratio (input “2” for 2% risk, please do not risk more than this)

- Stop-Loss Pips (use the total number of pips calculated in Step 2 from above – we used 50 for this example)

- Currency Pair (select the currency pair that you are trading – we used the EURUSD for this example)

- Click on the “Calculate” button at the bottom to see your lot size

In this example, our lot size is 1 standard lot or 100,000 units (i.e., a mini lot is 10,000 units). We would open our EURUSD trade with 1 standard lot, then place a 50 pip Stop and a 79 pip Limit (we used a 18.5 5Min value for this example – your values will by different).

Managing Scalping Matrix Trades

Managing a Scalping Matrix trade is pretty simple. The hard part is calculating your Stop, Limit and Lot Size (and that’s not very hard either). Once open, let your trade run until your Stop or Limit are triggered, or UNLESS one of the following occurs:

- If the PBT data reaches >+9 or <-9 in the same direction as your trade, close your trade.

- If the Scalping Trend data reaches >+9 or <-9 in the same direction as your trade, close your trade.

- If you are within 30 minutes of high-impact news (i.e., NFP, Central Bank Update, etc…) that is related to either the Base or Quote currency that you are trading, close your trade.

As always, if you have any questions, please ask and we will be happy to help! We also have live example on our Forum (here).

NOTE: Please demo trade first before using live funds! While demo trading, you should establish a consistent pattern of winning trades before you begin trading real money.